This article explores the history of human’s relationship with the yellow metal in the last five centuries. For ease of comprehension, the story is broken up into 11 parts.

Table of Contents

1. Ancient History and Classical era (8th century BC and the 5th century AD)

In Egypt and the Middle East, 5 centuries ago, gold and other metals fulfilled the functions of money, as a medium of exchange, means of payment, and store of value. However, its utility in economic transactions was still not popular.

Lydian King Croesus, in 560 BC, was the first to mint standardized gold coins with the same size and value as a medium of exchange. These standardized gold coins, in addition to their intended purpose, guaranteed the quality of the rare and precious metal.

The Roman Empire, in 225 BC, started using gold coins for economic transactions. This came about as a result of the glut and subsequent crash of their silver currency. The oversupply of silver from the Roman colonies led to this eventuality. Soon, Roman gold coins or Solidus were widely circulated and remained the dominant currency in Europe, Northern Africa, and Asia Minor until the beginning of the 12th century.

2. Medieval Era (5th century to 15th century)

Silver was the preferred metal for coins in the middle ages. Gold served as a store of value rather than as a means of payment because of its rarity and the higher value when compared to silver. Ultimately it was the Crusades and the newly developing long-distance trade that helped in establishing gold as a means of payment. In Europe, during medieval times, gold was valued 10 – 12 times silver.

The hallmarking of gold began in 1300 to ensure the quality of gold. Hallmarking is a system to verify and guarantee the purity of gold. This was started in London and followed elsewhere, thus establishing a common standard for gold purity.

The 14th and 15th centuries witnessed a sudden rocketing of gold values. A decline in gold mining in Europe and a consequent reduction in the new gold supply is considered the main reason for this. This led to an 80% decrease in coin production, making gold coins rarer. The price of this precious metal shot up, paving way for constant deflation.

3. Early Modern Era (15th century to 18th century)

The Discovery of the New World changed the course of history in many ways. When Europeans found their way to the Americas, resulting in the subjugation of the natives and plundering of their resources, vast quantities of gold found its way to Europe in the early 16th century. The arrival of fresh gold supply eased the deflation and ultimately led to inflation in Spain. This trend caught up in the rest of Europe and much later in Asia.

During the late 16th century, the glut of gold from the Americas led to further loss of value for this precious metal. This situation was aggravated by the mixing of other metals such as copper with gold for coins, resulting in its loss of purity. The Seven Years War (1756–1763) forced European countries to mint more of these low-grade gold coins.

The fixed gold-silver conversion rate was introduced in the United Kingdom by Sir Isaac Newton, the warden of the Royal Mint, as a measure to combat the fluctuations in the value of gold coins.

The British Parliament in 1774 introduced the Gold Standard. The Gold Standard is a monetary standard in which the strength of a nation’s currency is determined by its gold reserves, i.e., the quantity of gold it holds.

The 18th and early 19th centuries witnessed the co-existence of gold and silver coins. With the introduction of a fixed conversion rate for the two metals, the European countries and the US began minting coins in both gold and silver simultaneously. In France, from 1795, the fixed conversion rate was set at 15:1. This means gold is 15 times more valuable than silver.

4. Classic Gold Standard (1816 – 1914)

Great Britain made gold its official national currency with Lord Liverpool’s Act on 22nd June 1816. The convertibility of gold and Pound Sterling was legally guaranteed on 1st May 1821. All these lead to other countries pegging their currencies to the British Pound, thus making it the reserve currency. This move established British dominance in international finance and trade relations. By the end of the 19th century, the British Pound was the currency used for two-thirds of world trade and most countries were holding it as their foreign exchange reserve.

American Civil War and Gold Speculation: From 1810 to 1833, the US pursued the de facto silver standard. The gold price stood at USD 19.39 for one ounce of pure gold. The US government set the gold-silver conversion rate at 16:1 by the Coinage Act of 1834. This led to the implementation of the de facto gold standard and the price went up to USD 20.69.

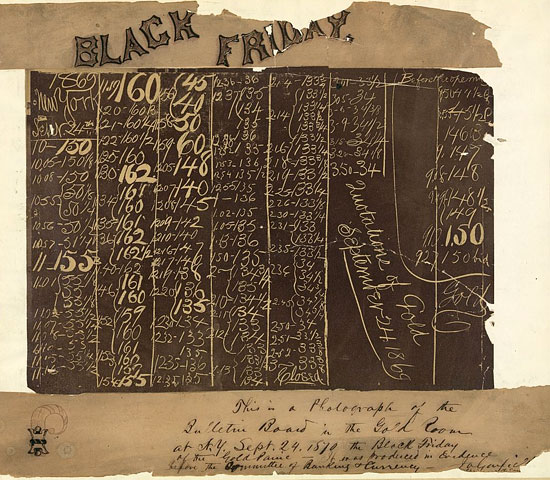

The American Civil War (1861 – 1865) and later on the Black Friday at the New York Stock Exchange on 24th September 1869 triggered skyrocketing gold prices to USD 47.02 and USD 155, respectively. per ounce. In 1879, the US government set the gold price at USD 20.67 and reverted to the gold standard. With the implementation of the Gold Standard Act, 1900, gold was made an official means of payment.

5. Between the Two World Wars (1918 – 1939)

The poor coordination and improper implementation of the partial gold standard paved the way for the overvaluation and undervaluation of important national currencies across the world. This ultimately resulted in the collapse of the new gold standard as a regulatory system of the international monetary system. The last straw that led to this breakdown was the decision of the Bank of England to suspend redeeming gold in 1933. This translated to the stoppage of the system that allowed citizens to exchange paper money for gold.

In 1933, Franklin D. Roosevelt, the President of the USA, announced the prohibition of possessing gold by citizens. The citizens were asked to exchange gold of any form – coins, bars, and certificates – for a fixed rate of USD 20.67 per ounce. The sole exception allowed in this order was for the gold used for industrial and artistic purposes. The rationale of this move was the prevention of the circulation of privately-held gold that was threatening of becoming an alternative currency.

A violation of this prohibitory order resulted in a fine of USD 100 or 10 years in prison. The citizens were allowed to possess up to 5 ounces of gold. This means the majority of the population was not affected by the order. This order remained in force for 40 years when it was finally abolished. The Exchange Stabilization Fund was established on 31st January 1934 and the price of gold was fixed at USD 35 per ounce.

6. Bretton Woods System (1944 – 1971)

Goal: With the US Dollar being the reserve currency, the exchange rate for gold could be set for long periods in advance. The Bretton Woods Agreement made it obligatory for the United States to redeem the foreign reserves of signatory countries held in the US Dollar for gold.

The purpose of the new system was to enable free trade among the participating countries on fixed exchange rates. To oversee the functioning and implementation of the Bretton Woods System, two institutions were established – International Monetary Fund and the International Bank for Reconstruction.

Triffin Paradox: The Belgian-American economist Robert Triffin was the first to detect a flaw in the Bretton Woods System in 1959. The Triffin Dilemma pointed out the conflict of economic interests between short-term domestic and long-term international objectives for the United States, whose currency served as the global reserve currency. When the US Dollar was elevated as the global reserve currency, foreign nations were holding more of it than the US central bank had gold reserves. To maintain liquidity for international trade, more US Dollars had to be printed. This move would lead to a deficit in the balance of payments for the United States. To overcome this dilemma, Triffin suggested the creation of an artificial currency. The International Monetary Fund (IMF) came up with Special Drawing Rights (SDRs), a supplementary foreign exchange reserve maintained by the IMF.

London Gold Pool: In 1960, when the foreign liabilities of the United States exceeded their national gold reserves, it started threatening the Bretton Woods System. To avert this danger and to sustain the system, the United States and seven European countries decided to pool their gold reserves to maintain the stability of the system and defend the gold exchange rate at USD 35 per ounce as a market intervention in the London Gold Market. The central banks of these eight nations managed coordinated gold sale/buy to counter the fluctuations in the market price of gold.

Crisis: In 1967, Charles de Gaulle, the French President, withdrew France from the London Gold Pool citing the Vietnam War. Simultaneously, the British government devalued the British Pound. These events led to a spike in the demand for gold, upsetting the applecart further.

Collapse: In 1969, multiple signatories of the Bretton Woods Agreement came forward to redeem their foreign reserves for gold. The United States was in no position to honor their commitment to the agreement. The United States could not manage to redeem the dollar reserves of even one participating country because the foreign reserves in the US Dollar of all the signatory nations had reached an all-time high. In 1971, the US President Nixon unilaterally canceled his country’s contractual obligation of direct redemption of the US Dollar to gold, known as the Nixon Shock. This move ultimately resulted in the collapse of the Bretton Woods System, thus ending the fixed pricing of gold at USD 35 per ounce.

7. Bull Market: Upward Trend (1971 – 1980)

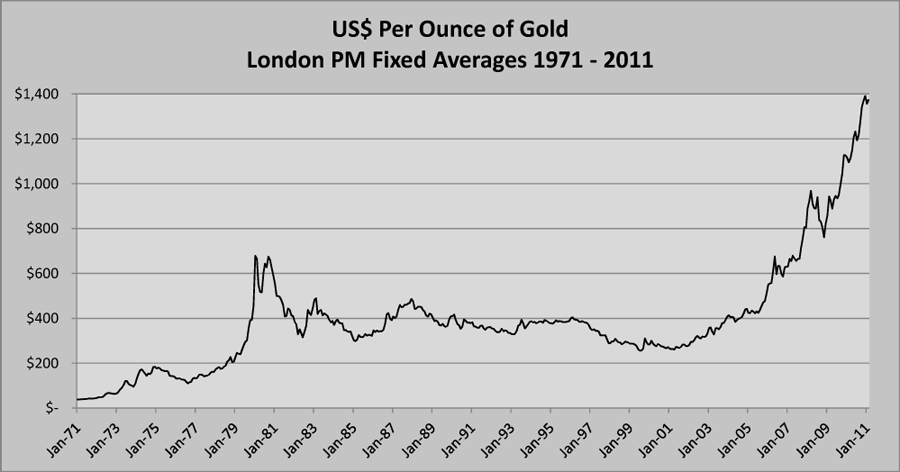

The aftermath of the collapse: The major consequence of the cessation of the Bretton Woods System was on the price of gold. Gold started trading freely on world markets. On 1st May 1972, the gold price went beyond USD 50 per ounce for the first time. During the first quarter of 1973, the currency markets had to be shut down for 14 days as a measure to contain the situation. Finally, the Bretton Woods System was abandoned and succeeded by a system of free-floating currencies and flexible conversion rates devoid of pegging to gold and US Dollar.

The beginning of gold trade: On 14th May 1973, the price of gold crossed the milestone of USD 100 per ounce. By 14th November 1973, the US government lifted the restrictions on possession of gold by private citizens. In the coming years, many more countries followed suit by allowing its citizens to own and trade in gold. By 1975, the New York Commodities Exchange was established and trading in gold futures began.

Jamaica Accords: These were a set of international agreements reached in 1976 that ratified the abolishment of the Bretton Woods System and amendment of the ‘articles of agreement’ upon which the IMF was founded. With the Jamaica Accords, an agreement was reached regarding the future of the gold standard and international currencies. The International Monetary Fund eliminated the pegging of gold to the US Dollar and recognized managed floating exchange rates. This made currencies fiat money, not redeemable by gold. Theoretically, the money supply is expandable infinitely.

The 1970s witnessed industrialized countries experiencing stagflation, a period of slow economic growth, low productivity, and high unemployment (stagnation) while prices rose (inflation). The troubles of the decade were made manifold by the uncertainties in the financial world, the oil crisis, a monumental increase of the US national debt, a huge jump in money supply, and an exodus of investors to material assets. The gold price went up 15-fold during this decade.

On 27th December 1979, the gold price soared to a new high of above USD 500 per ounce. By 21st January 1980, the price of gold stood at USD 873 at the New York Commodities Exchange. The Iran crisis and the occupation attempt of Afghanistan by the Soviet Union were cited as reasons for this surge. This all-time high gold price was the beginning of the end of the bullish trend of the markets. This price was not breached for the next 28 years.

8. Bear Market: Downward Trend (1980 – 2001)

1980 witnessed the beginning of a slump in the international markets. The US treasury, as a market initiative to end the economic stagnation, clamped down on the increase of money supply. The short-term effect of this was a steeper recession and a worsening unemployment rate. However, in the long run, this worked well for the economy, gradually stabilizing it and bringing inflation under control. In the 1990s, the United States experienced an extended economic upturn under President Bill Clinton. The New York Commodities Exchange merged with the New York Mercantile Exchange (NYMEX) in 1994. By 1999, the gold rate in London had come down to USD 252.80 per ounce.

In 1982, China allowed its citizens to possess gold. The establishment of the Shanghai Gold Exchange in 2002 led to further expansion in the gold trade, resulting in huge demand for the yellow metal. Earlier, it was mandatory to sell gold to the Chinese Treasury. In just five years, China surpassed the United States in gold trade to become the second-largest buyer of gold, after India.

To bring the price of gold under control by regulating its sales, 15 European nations signed the Central Bank Gold Agreement. This agreement places a cap on the annual sale of gold. The cap was fixed at 400 tonnes per year or 2000 tonnes for five years (CBGA 1 1999 – 2004). The consequent second agreement, CBGA II (2004 – 2009), limited the quantity of annual gold sales to 500 tonnes. The third agreement, CBGA III (2009 – 2014), brought down the limit of annual gold sales to 400 tonnes.

9. Bull Market: Upward Trend (2001 – 2010)

After the low of 1999, the price of gold had a slow recovery. Since 2001, the gold price has gone up at a steady rate. The rise in gold price finds a clear correlation with the steady growth of the US national debt and gradual weakening of the US Dollar against world currencies. The year 2005 witnessed a spike in gold prices, reaching USD 500 per ounce for the first time since 1987.

This trend continued and in just three years, in 2008, the price of gold doubled to USD 1000 per ounce. The already upward curve of the gold price was aided by the financial crisis. The demand for physical gold and Exchange Traded Funds (ETFs) skyrocketed. In 2010, the gold reserves of the largest Gold ETF, SPDR Gold Trust, went up to a record high of 1320 tonnes. This meant that the gold fund possessed and controlled more gold than the Chinese National Bank.

In 2010, many central banks decided to raise their gold reserves, the prominent among them being the Chinese National Bank, the Reserve Bank of India, and the Central Bank of Russia.

December 2010 witnessed gold price soaring to a record new high of USD 1431.60 per troy ounce. At the same time, the US Dollar slumped to an all-time low. The uncertainties about economic recovery, inflation, and growing national debt-fueled this trend. The decrease in gold production since 2001, rising demand for jewelry and strong interest from institutional investors also were contributing factors driving up the price of gold.

10. The Last Decade (2011 – 2020)

By August 2011, the gold price crossed USD 1900 per ounce. Gold once again became a safe investment option due to mounting US national debt, the financial crisis in Europe, and the looming threat of a new recession. From a price of just above USD 250 per ounce in late 1999 to just over USD 1900 per ounce, gold made a gain of almost 650% and an annual return of more than 18%. The closing gold price crossed USD 1900 per ounce only for a single day before it started a downward slide.

The most pronounced fall in the price of gold happened between October 2012 and July 2013. In a span of nine months, the precious metal lost almost a third of its value. The price drop continued to reach a low of USD 1060 per ounce in January 2016, before bouncing back. By June 2020, the gold price was USD 1751 per ounce.

On August 7, 2020, gold hit a new record of USD 2062.50. The economic uncertainty caused by the COVID19 pandemic was the reason for this sudden jump.

Gold Production through history

When the price of gold was doing a roller-coaster ride in the last 50 years after the abandonment of the fixed-rate Bretton Woods System, gold production saw a steady, at times steep increase. Rough estimates suggest an impressive two-thirds of the gold mined in human history happened after 1950.

Until 2006, South Africa was the largest gold producer in the world, its peak production coming in the late 1960s and early 1970s. After 2006, its declining production, coupled with increasing production by other countries led to South Africa losing the top spot to China. In 2019, China produced 383.2 tonnes of gold, accounting for about 11% of the total world gold production. Russia with 329.5 tonnes and Australia with 325.1 tonnes are not far behind.

World gold production witnessed a steep increase from 2500 tonnes in 2010 to 3300 tonnes in 2019. However, gold production seems to have plateaued since 2016. The main reason is the unavailability of ‘easy gold’. The present gold mines have been almost exhausted, which means for quality gold, miners have to dig deeper. This raises additional hazards and environmental concerns, in addition to the spiraling cost of production.

Humans have always been dazzled by the yellow metal and this trend shows no signs of abating. With the gold finding its use not just in jewelry and stakes so high, the demand for gold will continue to rise, driving its price to never before seen highs.