Is there any relationship between gold and crude oil? Two of the world’s most sought-after commodities have had a mostly close relationship in the past. However, with the introduction of global economic turmoil and geopolitical trade tensions in the mix has altered the gold-oil relationship drastically.

This article explores three theories to understand the correlation between gold and crude oil. The first theory suggests a simple positive correlation between the two. The second theory points to a negative correlation. And, the third finds a common driver for both commodities.

Theory One: Impact of oil prices on gold prices

The plain and direct line of reasoning suggests that high crude oil price doesn’t bode well for the economy. The crude oil prices on an upward trajectory can dampen the economic growth and play spoilsport in the share market. A bear market will prompt the investors to look for other avenues and assets for investment such as gold. This means, rising oil prices lead to more demand for gold, boosting its prices.

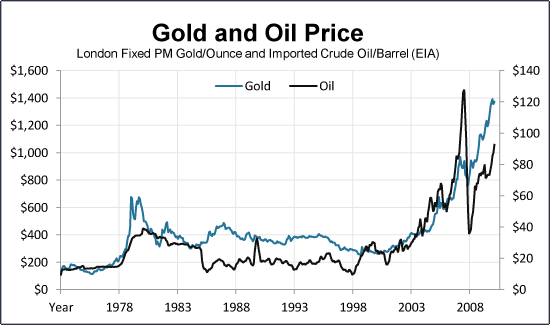

An instance of escalating oil prices driving up the gold rates could be seen in the 1978-80 period. The output of crude oil was brought down by the oil cartel to boost its price. This move had unforeseen ramifications on the US as well as the global economy, triggering an extended period of recession. One of the side effects of this turn of events was that this raised the demand for gold, which resulted in its prices scaling new heights.

Theory Two: Impact of oil prices on gold mining

As the crude oil gets more expensive, the cost of extraction of gold from mines goes up. This brings down the profit margin for gold mining companies, as a big share of the input in the gold mining industry is directly related to energy that comes from crude oil. This development would lead to a crash in the share prices of the gold mining companies.

Theory Three: Impact of inflation on gold and oil

International trade of gold and crude oil is carried out in the US Dollar. Thus, their prices are directly influenced by the strength of the currency. And, the basic measure of the strength or weakness of a currency is its inflation rate. As seen in theory one, the price of oil has a positive correlation with the price of gold. That is, the oil price has a direct influence on the gold price. However, another perspective of this eventuality is that both oil and gold prices are driven by the US Dollar, or in effect, by its inflation rate. The reason for this being the US Dollar and its rate of inflation is a common factor that affects both oil and gold prices.

After studying the prices of oil and gold in the past 50 years, we can detect a positive correlation between the two. However, this third theory suggests an alternative reason for their positive relationship, other than directly influencing each other. This is a perfect example when a positive correlation between two variables doesn’t imply causation. That is, one doesn’t directly affect the other. This happens when there is another variable in the middle, related to both and influencing them. A change in one of the original variables