Common sense tells us that there is a strong relationship between the gold rate and inflation. When the inflation climbs up, so does the demand for gold and consequently the gold prices. The reverse of this also seems theoretically correct. A fall in inflation will lead to a fall in the gold rate. This looks like sane reasoning from an investor’s perspective. Because at times of high inflation, gold is more attractive as an investment option. However, the history of gold rate and inflation proves this wrong.

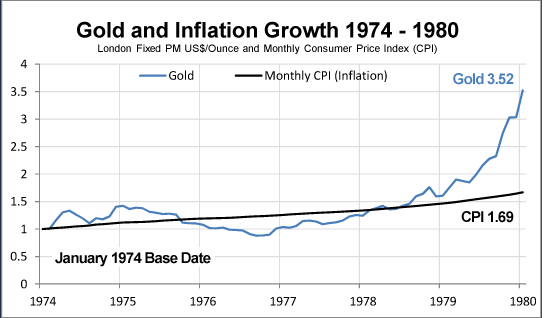

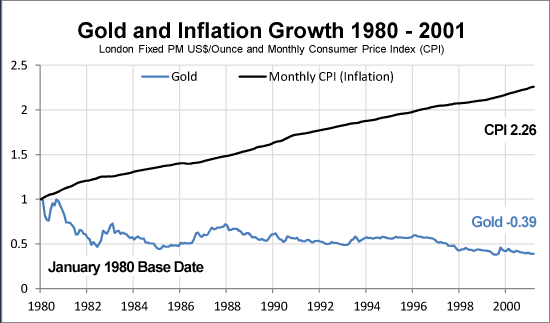

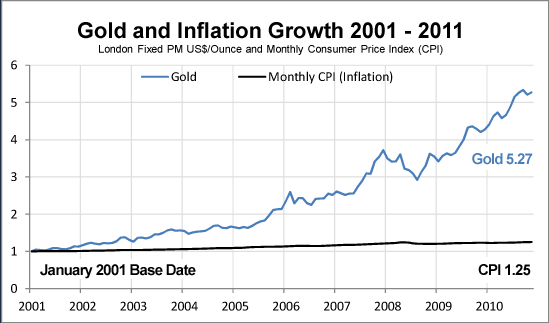

The first graph covers the bull run from 1974 to 1980. The second graph tracks the 21-year bear run from 1980 to 2001. The third and last graph shows the bull market from 2001 to 2011. A glance at these graphs itself reveals the non-existence of any relationship between these two parameters.

Bull Market (1974 - 1980)

During the bull run of the market from 1974 until January 1980, the gold rates increased from USD 129 to USD 675 per ounce, an increase of 352%. During the same period, the consumer price index, a measure of inflation, went up by 69%. It is very clear that the gold rates outperformed inflation.

Bear Market (1980 - 2001)

The bear run during the period helped to bring down the gold rates from a peak of USD 675 in 1980 to USD 260 per ounce in April 2001. A slump of 39%. While the consumer price index in the same period went up by 126%.

Bull Market (2001 - 2011)

The bull run in the first decade of the 21st century saw the gold rates surge like never before. It increased by 527%. In contrast, the consumer price index increased by only 25%.

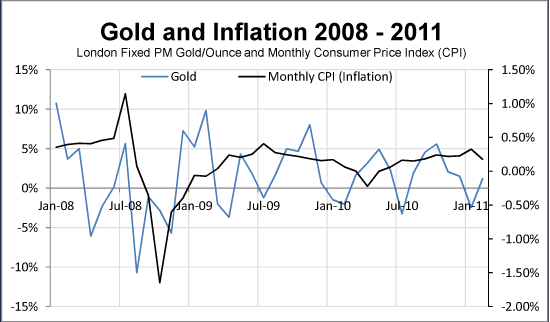

The most remarkable point to note here is the decrease in inflation after mid-2008, even as the gold rates surged ahead. Had there a positive correlation between the gold rates and inflation, the gold rates should have come down with inflation at that point in time. However, the opposite happened. Even as inflation came down, the gold prices went up with added vigor. This points to a negative correlation between the two.

Detailed studies of these three important periods in history point to a weak or more likely a non-existent correlation between the gold rate and inflation.

What do experts say?

The Wall Street Journal authorized a study that was carried out by the research firm Ibbotson Associates. After detailed research, they arrived at a correlation value of 0.08 for the period between 1978 and 2010 for the gold rate and inflation. This is as good as no relation. (Correlation value ranges from -1 to 1, -1 being the perfect negative correlation, 1 is the perfect positive correlation and zero is the absence of any correlation).

Another study commissioned by Citibank in 2009 also came to the same conclusion that “there is no obvious relationship between the gold price and inflation”.

As can be seen by studying the three graphs given above, the gold prices somewhat follow inflation at times, but on other occasions, it shows an inverse or a weak relationship with inflation.

Using these data, the only conclusion that can be drawn is that there is no correlation between the gold rate and inflation.